Here at Tallgrass Title, once we receive the signed contract in our office, the clock starts ticking on our countdown to get everything out in a timely manner. Our goal is to be efficient, friendly, and fast in all aspects of what we do, but, sometimes the fast part does not always happen as fast as we would like. We get asked often what the time frame is to close a transaction. In most instances, we are able to say that we can have it done within 30 days. There are situations where that is not possible and there are situations we can close in as little as a few days. The following is a rough timeline of the steps we take to get transactions closed in order to give you an idea of the potential timeline for your unique closing.

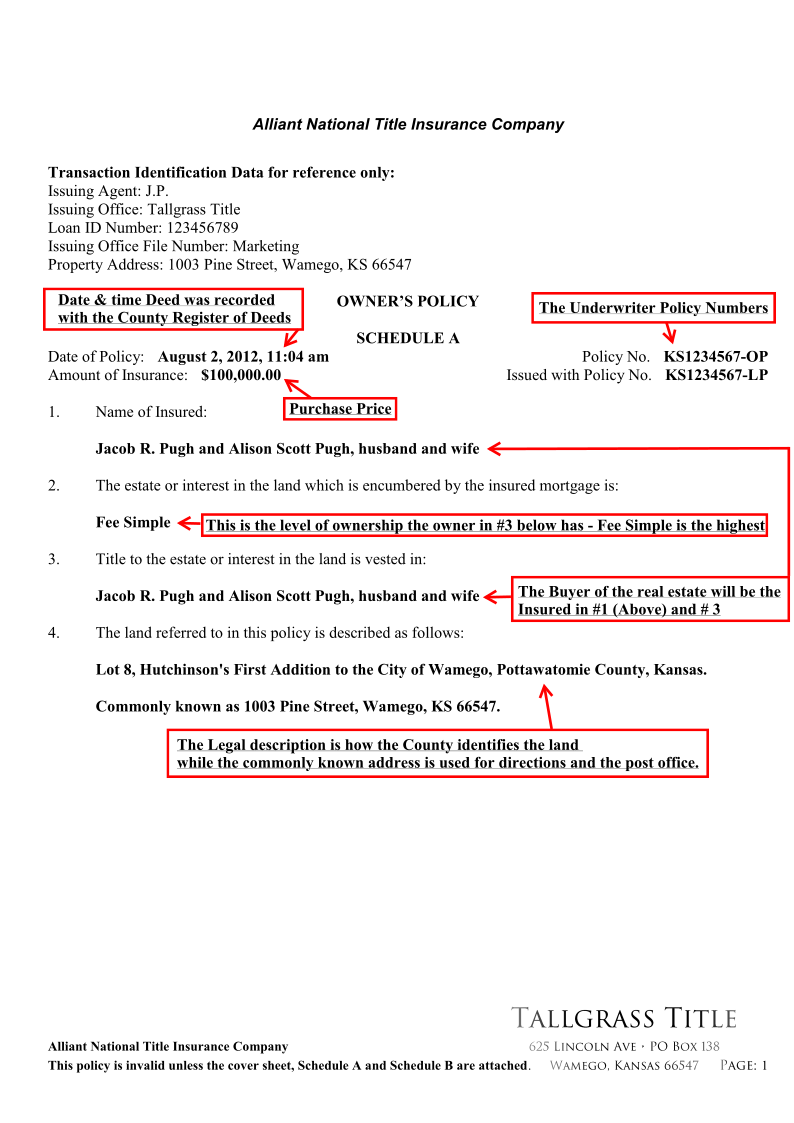

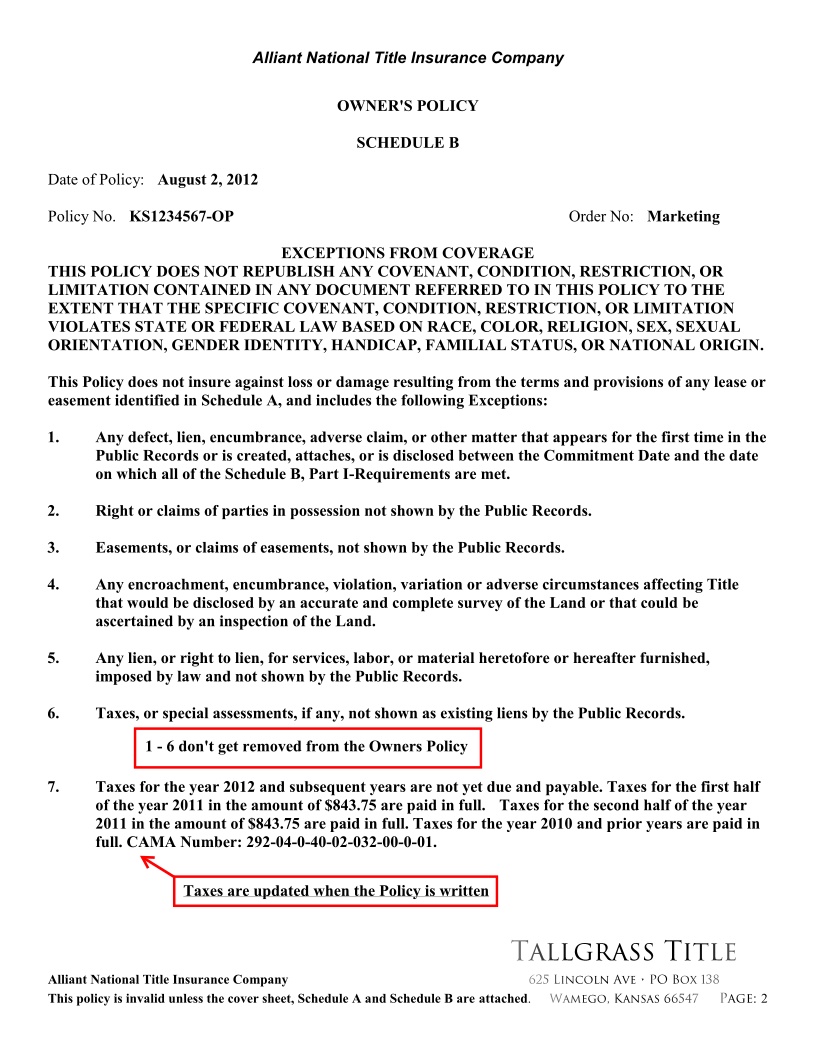

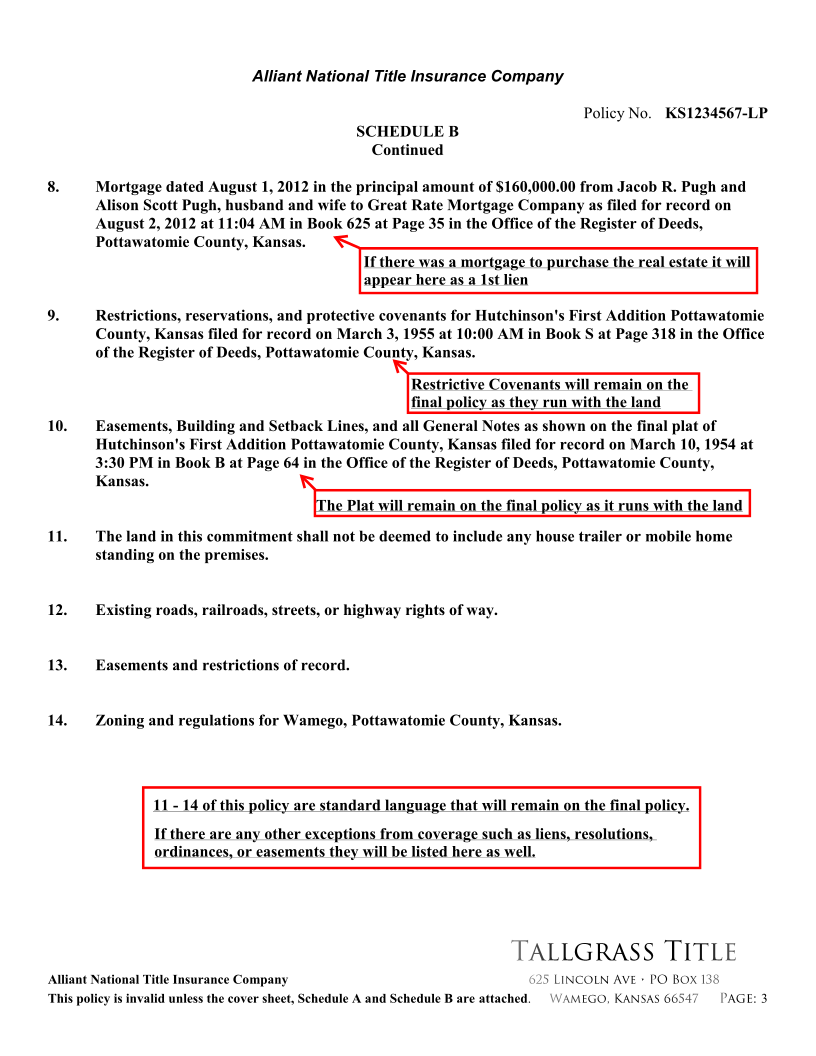

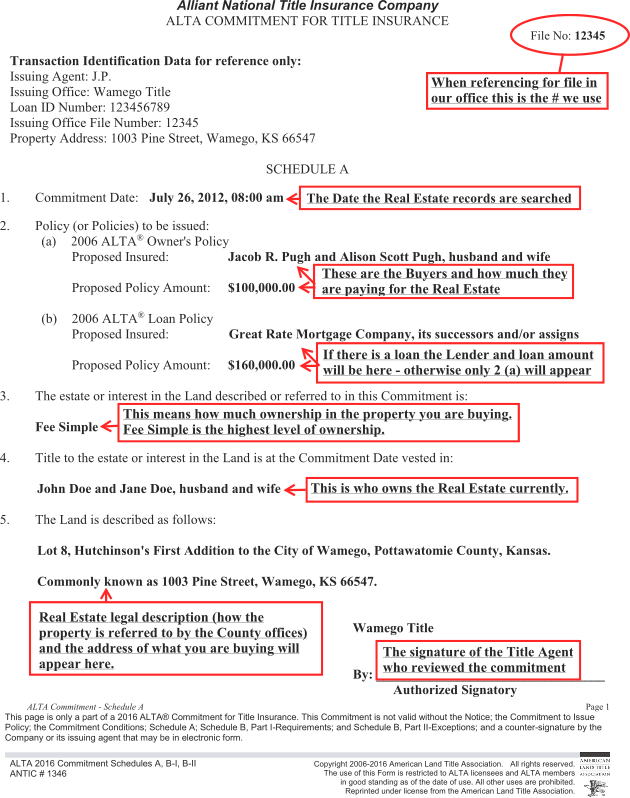

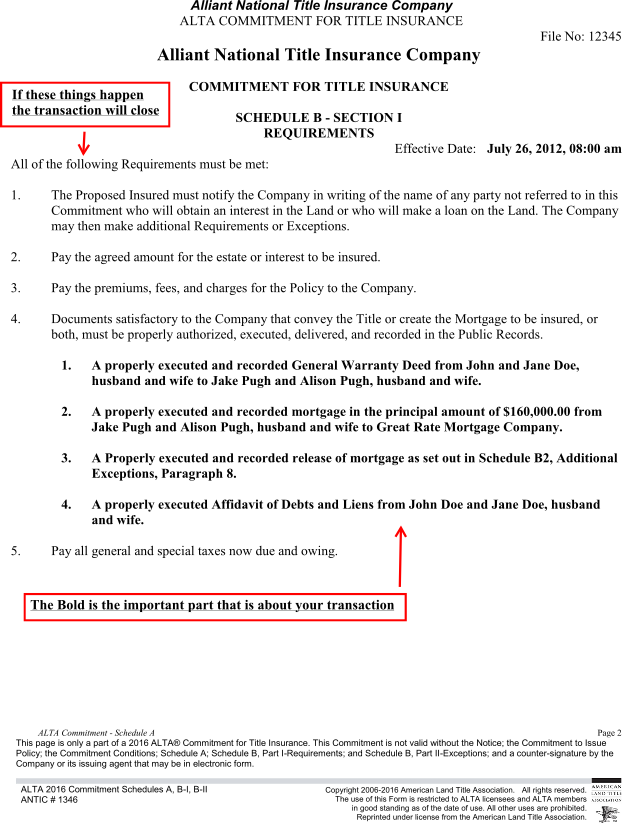

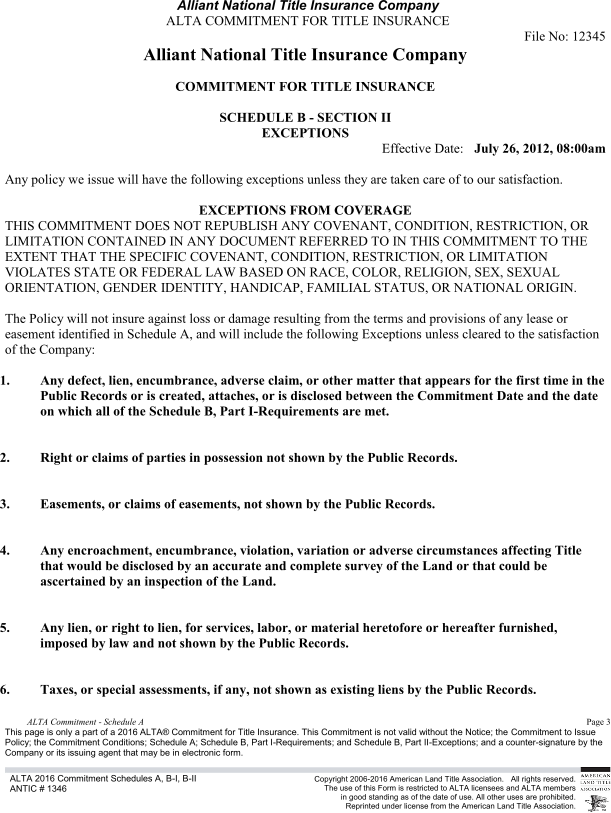

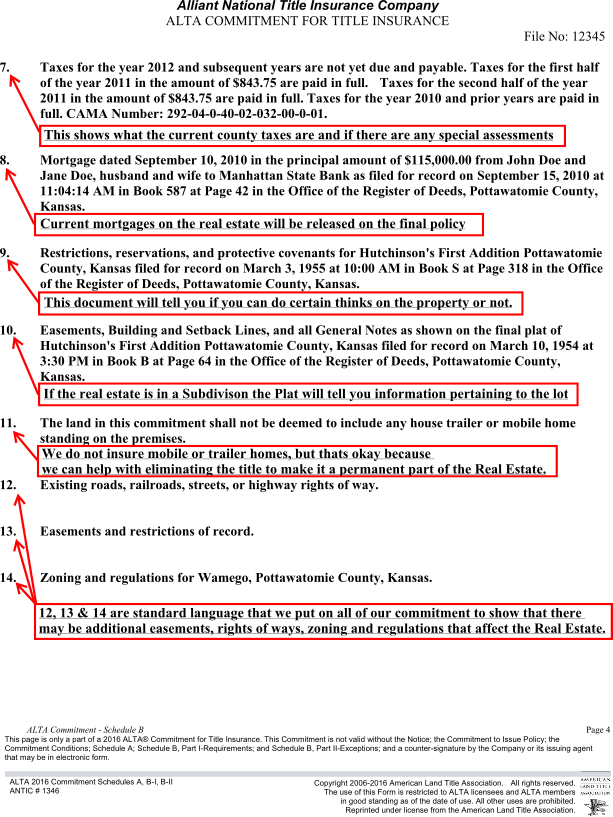

Commitment

Within 24 – 48 hours of receiving a signed contract we try to have to commitment issued to all parties. This can take longer depending on whether additional research is needed to clear the title. Generally, this means tracking down additional documents to trace the chain of title or add exceptions.

Preliminary Documents

Once the commitment is sent out, the file is assigned a Closing Agent. Your Closing Agent will put together two preliminary packets: a Deed Packet and Buyer Documents. These packets will then be sent to the clients’ respective realtors or directly to the clients (if unrepresented) to get reviewed and signed prior to closing. Getting the preliminary packets signed and returned well in advance can help make the process smoother as we sometimes experience delays in the process of getting payoff instructions from lien holders.

Invoices and Payoffs

Once both of the preliminary packets have been sent out, the Closing Agent begins working on the preliminary settlement statements. With a cash transaction this can mean closing as soon as the deed packet and buyer docs have been returned, we receive any invoices and payoffs we need to obtain, and the buyer and seller are both ready to close. For a transaction that is being financed the process is a little longer. The lender has to disclose fees three days prior to closing, we need have underwriter approval or a “clear to close” status, and the bank has to have the property appraisal back.

Closing

Once we have everything in our office we need and the lender, if there is one, has received approval to close as well –what’s next? We will set up a time for closing either at the bank or in our office.

Cash Sale Closing

Buyers and Sellers may sign all their final documents electronically and certified funds can either be wired or dropped off at one of our offices. After disbursement and recording the deed, the transaction is complete!

Financed Closing

When there is a mortgage involved, we ask you block off about an hour for closing as there are several documents to work through and sign. Once signing is complete, we will send the loan packet to the lender for funding authorization. Once we have authorization and all funds, we will disburse, record the deed and mortgage, and the transaction is complete.

We strive to make the closing process as smooth and easy (and quick) as we can. Hopefully this gives you better picture of the timing of your unique transactions. We are here to facilitate everything and take the pressure off you and your clients. Please feel free to give us a call with any questions you have.