As a Lender, do you have clients who want to build a new house on their lot? Here at Tallgrass Title, we offer a construction hold-open, also known as a construction commitment or policy. We get questions about this product quite often, so we thought we could help clear up some of the confusion surrounding this topic.

How it works:

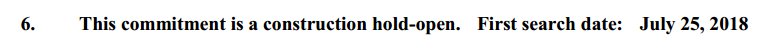

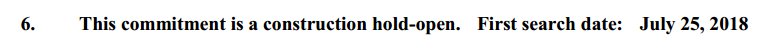

You, as the lender, contact us, the title company, to request the title work. An email sent to order@tallgrasstitleks.com is sufficient, or you can fill in the online order form on our website. We complete the title search and send the commitment to you. The commitment will contain a specific set of construction language and the date of the first search. Here is an example of what that commitment language might look like:

The title search must be updated every 120 days. This is because title insurance commitments have expiration dates. Here at Tallgrass Title, we keep an eye on the expiration dates and remind you when it is time to request an update. You can just send us a quick email to “officially” request the update. We keep the message in our file for our underwriters to see. Our initial construction loan fee covers the cost of the initial search, plus two update searches.

When construction is complete, the loan can be closed. At that time, the lender can determine if the initial mortgage will stay in place or if a new mortgage will be filed. The cost of the final policy is charged at the final loan closing as soon as the title company has been notified of the final mortgage amount. The lender’s policy is generated and sent to the lender after the final loan closing has happened.

FAQ’s:

• The property owners want to remodel, will a construction loan work?

– At this time, the title construction commitment is only for new construction, not for a remodel of an existing structure. If the house is already standing, the construction commitment is not something we can offer you. It has to be a new structure, or a brand-new wing added on to an existing structure. You may need to consider a 2nd mortgage, HELOC or some other financing product.

• The construction is going over-budget. How does that affect the construction commitment?

– We are very flexible when it comes to the projected loan amount. If the amount needs to be increased, we can certainly do that once you send us the request.

• Our clients haven’t yet purchased the lot they want to build on. Do they have to purchase the lot, then get a construction loan?

– We can work with lenders on the lot purchase and construction hold-open as parts of the same transaction. We can issue the owner’s policy soon after the initial sale closing and issue the lender’s policy later, once the construction is complete.

• The sale transaction closed, when will we get the lender’s policy?

– As mentioned above, we cannot issue the lender’s policy until the final mortgage has closed and has been filed. As soon as construction is complete and the mortgage finalized we can go ahead and issue the lender’s policy.

Here at Tallgrass Title, we work to make the deal go as smoothly as possible. Give us a call today and we will be happy to answer any questions you may have about construction title policies!