We’re starting a new series on the Tallgrass Title blog: Legals with Lippman! In this series, our Production Manager, Sydney, will be focusing on topics related to real estate legal descriptions. Sydney will help make sense of plats (and replats), original townsites, water rights, condemnations, and how all of this affects you and your clients’ transactions.

Section-Township-Range Legal Descriptions (and Why Surveys Can Make Your Life Simple)

Legal descriptions are a graphic depiction of a property. They outline the boundaries and features of a tract of land creating a map.

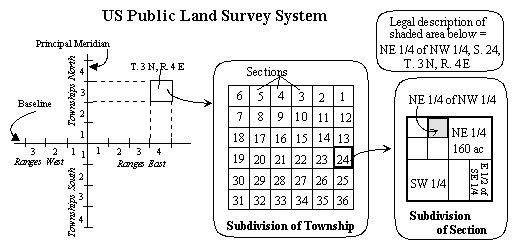

Legal descriptions commonly start out with a section-township-range description (with the exception of “platted” ground which will be covered in a future post.) This type of surveying system was adopted in 1785 and is used throughout the United States. Through this system townships and ranges are separated into sections, each section totals 640 acres and is one square mile, forming a grid pattern to help locate a given property. Townships run north and south while ranges run east and west. Each township range is broken into 36 sections making them 6 square miles.

Many legal descriptions start by dividing sections into quarters, halves, and quartered quarters. However, when real estate is broken down further, it can get a bit complicated. For example, suppose that in 1901 John Jacob purchased the NW/4 of Section 10, Township 10, Range 10. Then, John Jacob gave a portion of the property to each of his four children and each received a quartered quarter. Allen Jacob received the SW/4 NW/4 of 10-10-10. Allen wanted to pass this land on to his two sons but wanted the house to go to his daughter. This is where things can become less cut and dry. Allen decided to divide the property along a stream that runs halfway through the property. Everything North of this stream went to Bart, everything South went to Chester. Seems simple, until you take out the house and five acres surrounding. The five acres and the house are also along this stream. This is where a survey of metes and bounds legal description comes into play.

A surveyor will draft a legal description beginning at a designated starting point; also called a point of beginning. In this case it might be the southwest corner of the northwest quarter of Section 10, Township 10, Range 10. A particular degree and number of feet is then determined, and the legal description continues through a variety of angles and distances until it comes back to the point of beginning. This creates a map of the property boundaries.

After reading the above example, one can see that there are many instances where a survey is needed to produce a metes and bounds legal description. They can help resolve any possible boundary disputes, accurately determine the size of a tract of land, or to determine the location of any easements, setbacks, or other such restrictions on future development.

Surveys can also be extremely helpful when a legal description has become convoluted. Say John Jacob decided to sell half of the NW/4. Peter Crow now owns the N/2 of the NW/4. Peter then sells the South 10 acres of the N/2 of the NW/4 to Monica Chang. Monica sells four one-acre tracts off for housing development. Monica’s legal description is now the South 10 acres of the N/2 of the NW/4 of 10-10-10 less one acre less one acre less one acre less one acre. Having a survey done of the remaining six acres would simplify her legal description. .

Dealing with legal descriptions can be tricky, that is why we are here to support you. If you have any questions about section, township, range legal descriptions or surveys feel free to contact one of our real estate professionals for guidance.