When it comes to purchasing a new home, you are making a long-term commitment with your money and your time. One oversight when purchasing is the consideration of the history of the home. I do not mean the structural integrity of the home rather, the history of the legal title to the home. We are talking about the history of ownership of the land and the structure located on it. Title Insurance is a way of giving you peace of mind that you have full ownership of what you have just purchased, and that no monetary claims will arise from an individual or a business entity in the future. If that were to ever be the case, Tallgrass Title would have your back!

When it comes to Title Insurance, there are some pretty common misconceptions that might deter a buyer away from deeming it necessary. We want to help you navigate some of those misconceptions in order to make sure you are aware and get the coverage that you need.

If the Lender orders Title Insurance, the Buyer does not need to.

In most real estate transactions, the Lender involved will require Title Insurance. As discussed, Title Insurance protects from future claims of lack of ownership, liens, undisclosed heirship issues, ordinances, lack of right of access, etc. However, the insurance that the Lender requires only protects the Lender, not you as a Buyer. Two separate insurance policies exist that Title Companies offer: a Lender’s Policy and an Owner’s Policy. Often, a Lender will require the Buyer to purchase an Owner’s Policy. Most title companies offer a significant discount the the issue of simultaneous Lender’s and Owner’s Policies.

If I have Homeowner’s Insurance, then I do not need Title Insurance.

As previously mentioned, Homeowner’s Insurance only protects your home from damage caused by hail, fire and wind. Title Insurance protects your ownership and against aforementioned claims.

I have built a brand new home; therefore, I do not have to worry about ownership issues.

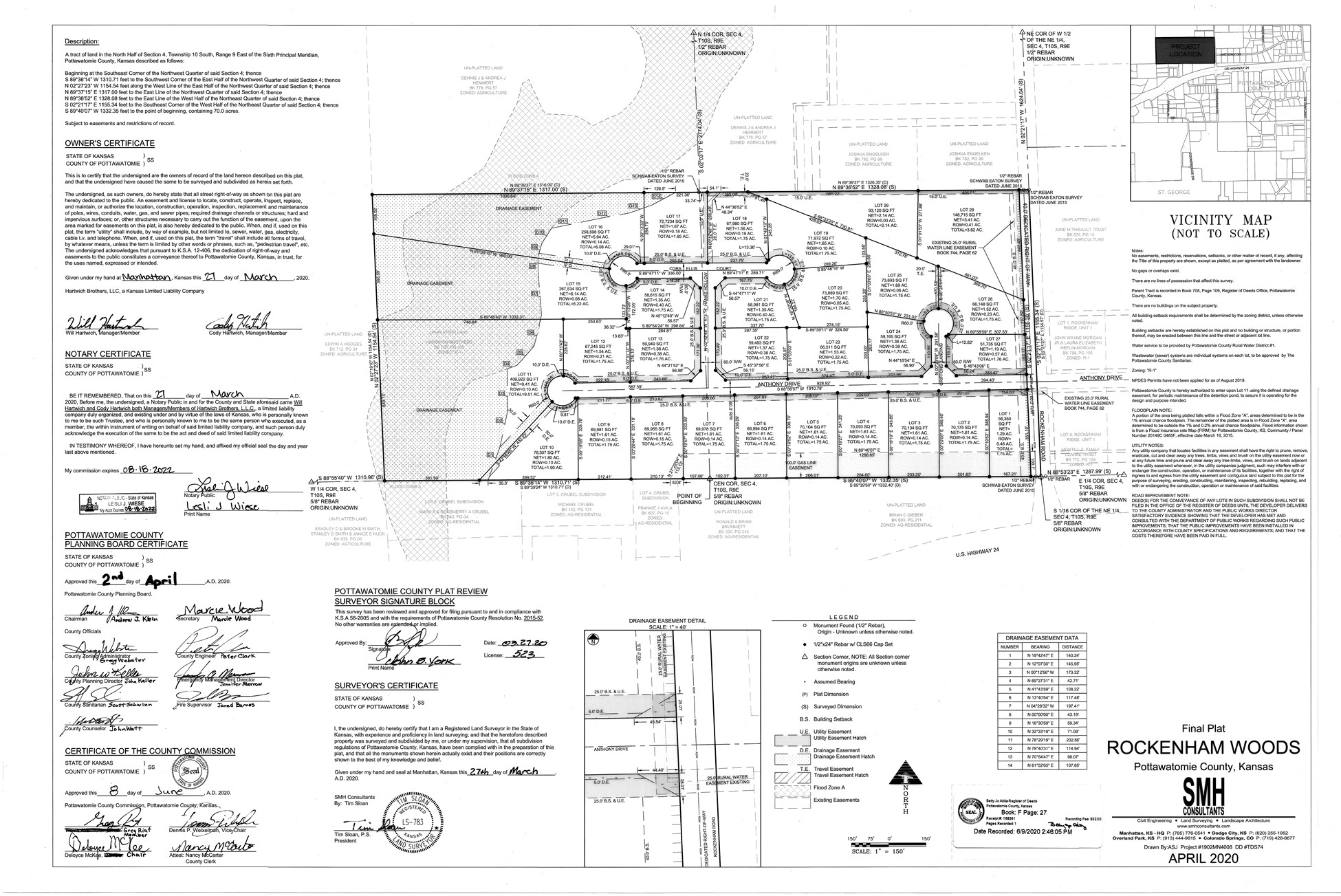

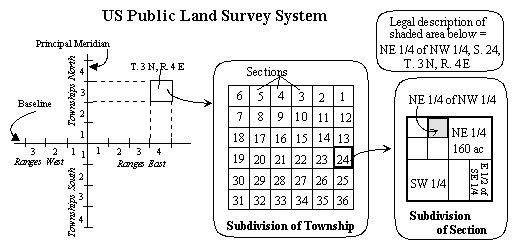

Although it is true that you are the very first owner of a home, the land that your home sits on has long been in existence and has had many previous owners. Title Insurance not only protects your house, but it also protects the land that your home is settled on!

Title Insurance is transferable from one owner to another.

While the idea that one owner can transfer Insurance to another does seem plausible, Title Insurance only covers specific owners of the specific property for their specific transaction for the duration of ownership. This coverage will end upon the transfer of the real estate, so each new owner needs to make sure they are protected.

Title Insurance is expensive.

When considering the amount of money being invested in your home, an Owner’s Title Insurance policy has very minimal cost, and unlike a Homeowner’s Insurance policy, Title Insurance is a one-time payment that protects you the entire duration of your ownership. Further, Kansas has some of the lowest title insurance rates in the nation.

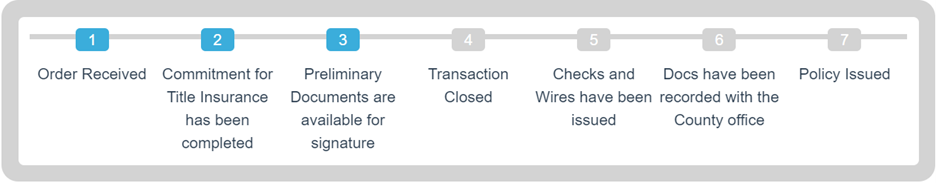

Not only does Title Insurance protect you, but your Title Company will also be there to help you navigate through the milieu of Real Estate and give you the assurance you need while owning your home! We are also here to answer your specific questions regarding what is covered. This can at times seem daunting, but our trained professionals are here to assist in these regards. That’s our job!