Last March we introduced our partnership with Earnnest, a tool that allows for the fully digital transfer of funds (much like PayPal or Venmo) but made for real estate transactions! That means it was designed with safety and security in mind.

Earnnest provides a way for the digital transfer of client earnest money into the title company of your choice’s escrow account, verifies “good funds,” and distributes documentation of the payment and deposit to all parties.

How does it work?

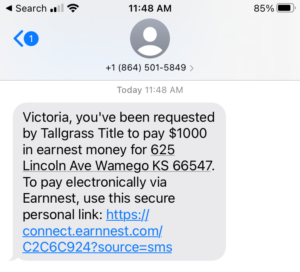

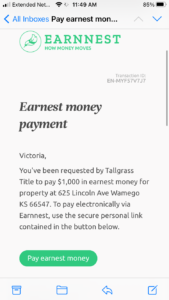

The title company or the buyer’s agent can complete a request for earnest funds through the Earnnest app. We are happy to complete this request on behalf of the realtor – just ask us! In order to, we will need your buyer’s email, phone number, the property address, and the dollar amount. Your client will then receive a text and an email that “Tallgrass Title” is requesting funds.

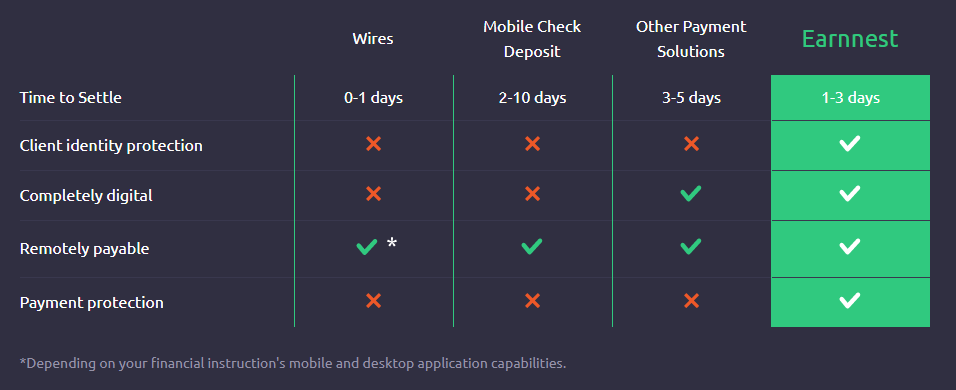

Utilizing electronic methods of contract signing and delivery along with Earnnest allows your client’s new home to go under contract in minutes with zero travel and zero wire fees. The only cost associated with Earnnest is a $15 processing fee paid by clients when they complete the request. With wire fees approaching $30 or $40, this saves you time and your client money.

What makes it secure?

Earnnest is partnered with the payment processor Dwolla, which sets up a secure connection between all parties with multiple levels of encryption. Earnnest uses Plaid to connect the buyer to their bank to complete the earnest money request and neither party obtains or stores your client’s bank account credentials or financial information.

It’s quick!

Once the buyer completes the request for earnest funds, all parties – the escrow company, the realtors involved, and the buyers – receive an email receipt verifying “Proof of Payment.” This tells us that the earnest money has been withdrawn from the buyers account, is verified as good funds, and is on its way! Within 3 days, all parties will receive another receipt called “Proof of Deposit” – this tells us that the funds are officially in the hands of Tallgrass Title. Contrary to how quick handing over a check seems, it isn’t always so fast. Personal checks can take up to 10 days to clear the bank. Earnnest is the cleanest and quickest way to ensure the secure delivery of earnest money.

While entirely coincidental, adding Earnnest to our toolkit when we did was a gamechanger! Many of our everyday business practices have changed and we will continue to adapt as we move out of the Covid-era. Adopting cutting edge tools for secure and paperless transactions will continue to be our standard. We’re happy to utilize PaperlessCloser, CertifID, Dotloop, HelloSign, Earnnest, and another nifty product we’ll share with you in a couple of weeks that is going to make mobile transaction information and document access a reality.

Earnnest has even more to offer than we can cover here, if your curiosity is brimming, give us a call! Or you can check out Earnnest here! And if your client wants to complete their earnest deposit through Earnnest, we’d be happy to place the request for you or show you how!