No, no. This is not about problems with Commitments, or even about Buyers shopping for a home for over a year and still not happy with anything. This is a series about the Title Commitments that we issue and how to make sure you understand what you are reading. We want to go in-depth and help break down just what purpose the Commitment serves as well as its different components. The end goal is for you to be able to receive the Commitment and know exactly what the general items and terms are and how to navigate them.

The Nature and Purpose of the Commitment

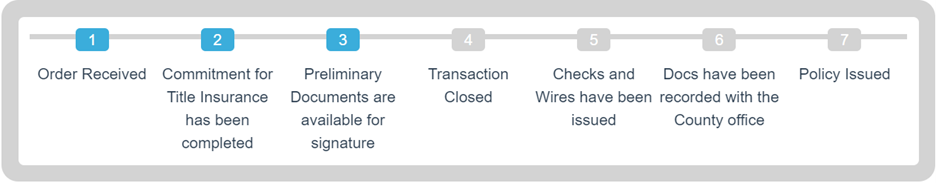

The Title Commitment is a report prepared by the title company containing specific information about the property to be purchased or that is currently owned. It also legally binds the title company to issue a Title Policy – it’s a commitment. The Title Commitment, issued prior to closing, is the stepping-stone to issuing the final Title Policy, which is issued after closing. The Commitment is not the Policy, and the Policy is not the Commitment, although there will be similar information given and shared between the two.

Your Commitment will contain four parts: the Commitment Jacket, Schedule A, Schedule B I – Requirements and Schedule B II – Exceptions. Let’s parse out each of these components and give a brief run-down of what each one is.

The Commitment Jacket

The Commitment Jacket is general, non-specific coverage that is issued from an insurance underwriter (the Insurance Company) to the title company (the Insurance Agent.) This will be included with each Commitment that we issue.

Schedule A

A “schedule” in its basic meaning is simply a written form or statement of details. Regarding Title Insurance, the schedules give specific information about the property and transaction. Schedule A gives a general description of property concerning its property address, legal description, how title is currently vested, and what types of policies are going to be issued after the closing takes place.

Schedule B – Requirements

Schedule B of the Title Commitment is broken up into two separate sections: Requirements and Exceptions. The first section (Requirements) details specifically what is needed to pass clear title and issue a final Title Policy. If a purchase transaction, you will typically see some form of deed, mortgage, mortgage release, and an affidavit. If refinancing, the only difference will be no deed to convey ownership. There may be some additional items in the Requirements that will need to be addressed, depending on what is found and listed in the Exceptions.

Schedule B II – Exceptions

The Exceptions contain all things pertaining to and running with the specific piece of real estate as mentioned in Schedule A. The Buyer/Owner has free and clear title to the ownership and use of the said real estate, with the exception that their rights to use the property are subject to all those items contained therein.

Stay tuned for the next blog in the series, as we will dive further into discussion about each of the components that make up the Commitment. And even if things are still somewhat confusing afterwards, feel free to reach out and give us a call! It’s what we’re here for!