Real estate fraud is alive and well as fraudsters find new ways to cheat people out of their money. Whether it be through fraudulent emails or posing as a realtor and calling clients to get them to send money. Title companies, banks and realtors strive to protect buyers’ and sellers’ money as if it was their own money. It is our job to protect our clients and ensure a smooth closing process for everyone. We were asked recently what we do to protect our clients’ sensitive information and protect their assets. We take this very seriously and want to share a few ways we do this.

ID Verification

When Sellers come to our office to sign documents to sell real estate, we check photo identification. We ensure the party “selling” is in fact the party in title and not a fraudster claiming real estate as their own.

Remote Online Notarization (RON)

Believe it or not, signing documents through a RON environment is more secure than signing in person. Signers must submit their photo ID while on a live audio-visual session, like in person. But they also answer KBA (Knowledge-based authentication) questions to verify their identity. We simply do not have that kind of capability in person and this adds an extra layer of identity verification.

Secure Wire Instructions

We work with CertifID to send and verify wire instructions. It takes a little extra time to verify your identity and banking information with this process. However, we do this to guarantee funds are getting to where they are supposed to be instead of being sent to a fraudsters personal account.

Earnnest

“You spelled that wrong.”

We hear this a lot, however, I assure you we know how to spell. Earnnest is a payment portal we use to request earnest money from our clients to satisfy the terms of the contract. It works a lot like Cash App or Venmo, is secure, and the Earnest Money goes straight from the buyers bank account to ours. We simply send your buyer a link to our custom payment portal and they complete payment. This reduces the need to navigate wire instructions and the possibility for human error. There is also a cost savings over cost of sending a wire, in most cases.

E-Signature Platforms

Our office utilizes Dotloop and HelloSign to get documents to clients securely. We can send view only documents or we can send documents with a request for information and signatures. This eliminates the requirement for password protecting a PDF in email and still applies the security necessary to protect sensitive information.

Password Protected

If our office does send out sensitive information via email, we will always password protect it to secure information that is not public knowledge, such as settlement statements. At any time, a fraudster could be hanging out in your email and open attachments that are not secured to see what the proceeds would be for a transaction, then reach out to you with bad wire instructions requesting you send your hard-earned money to then instead of to the title company for your transaction.

Why?

Wire fraud and other forms of cybercrime in the real estate sector resulted in $350 million in losses in 2021, up from $213 million in 2020. While only 12,000 people a year are victims, one in three real estate transactions is a target. This is why we remain vigilant in our own practices and in our efforts to educate our clients.[1]

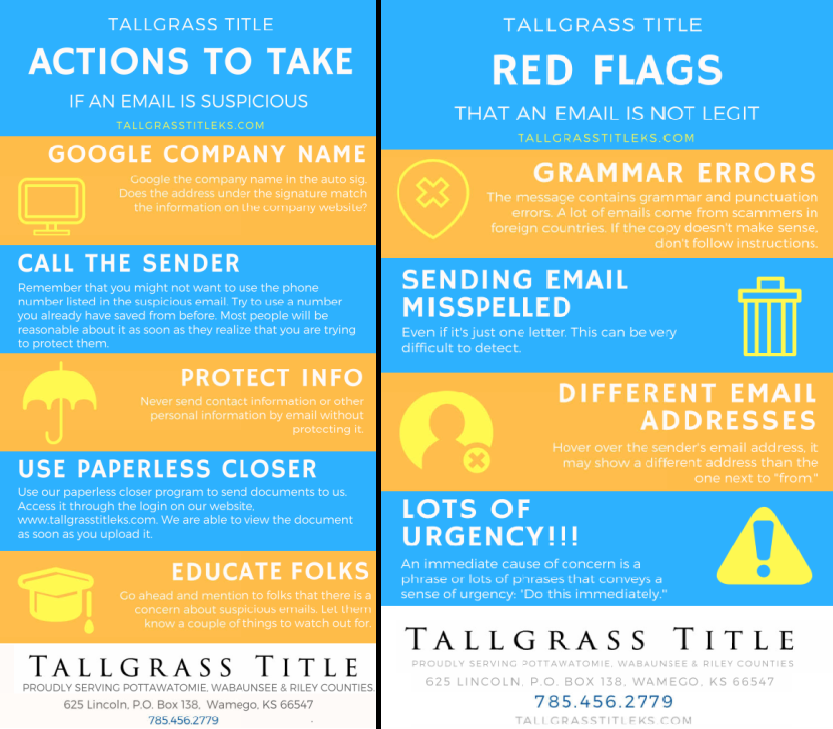

A staggering 35% of fraud attempts reported in 2021 were traced back to email. If you suspect a fraudulent email was sent to you, do not respond to it, click any links, or open its attachments. Reach out to your realtor, title company, lender, client using known information from a source outside of the email. Stay tuned for a follow-up blog on email security tips!

We are here to answer any questions you may have, protect your information, and help make your closing experience as smooth as possible.

[1] https://blog.alta.org/2022/03/cyber-losses-hit-69b-in-2021.html