How do I submit a new order and what info do I need?

Here at Tallgrass Title we are always happy to get new orders started for you and hope to make it as easy as possible. To do this, we offer three simple ways to submit new orders or ask questions. Whether it be a contract, refinance, informational report, or preliminary title, any of these methods should cover you!

Email or Fax

A simple way to contact us is through email. A quick email to order@tallgrasstitleks.com is all it takes to get us started. Whether it’s an order, a simple question, or preliminary title you are just getting started, we can get things going for you with minimal information. All it takes is a quick email.

We can also receive new orders through fax at (785)456–8581. Just send over your contract or title order form and we will get a file started for you!

Our Website

We can also receive new orders through our website: tallgrasstitleks.com! All it takes is to go to the website and follow the link on the main page to Submit Order or follow the Services drop down and click on “Get Started”.

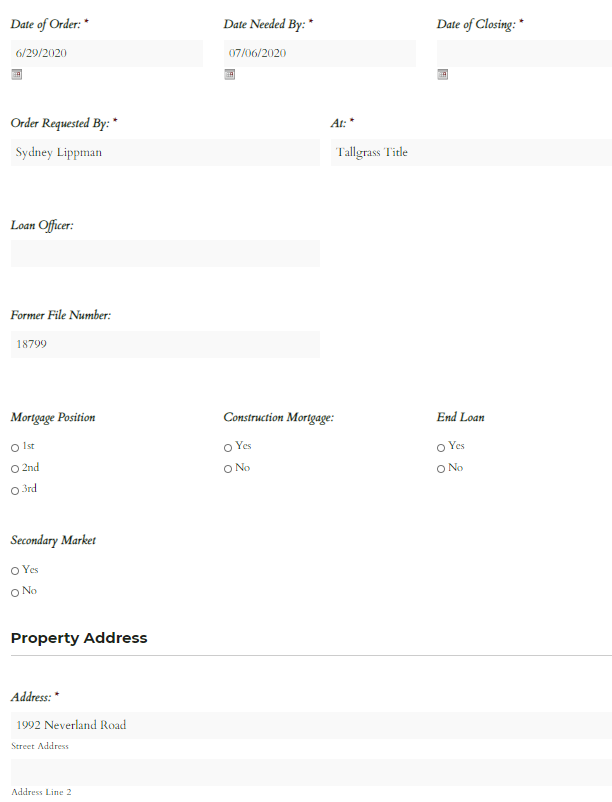

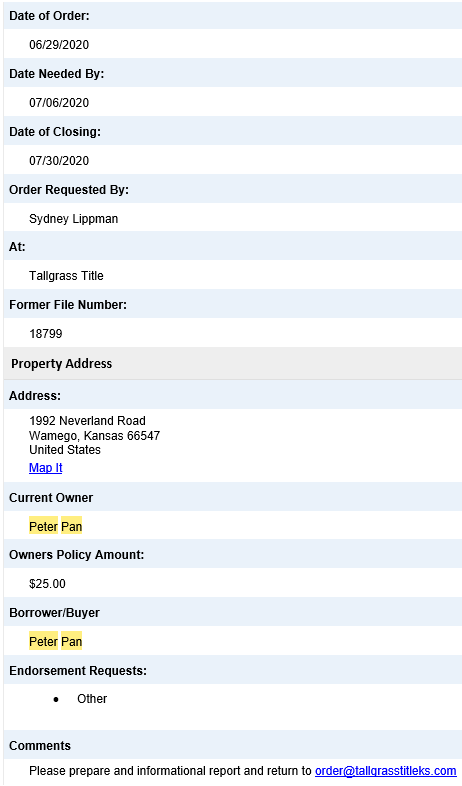

This will lead you to an online fillable order form. Just fill this in, to the best of your ability, and hit submit at the bottom. The fields marked with an * will help guide you through required information.

We will receive your order like this and get a file started for you.

Just remember to include your name and contact information so we can contact you with any questions!

PaperlessCloser

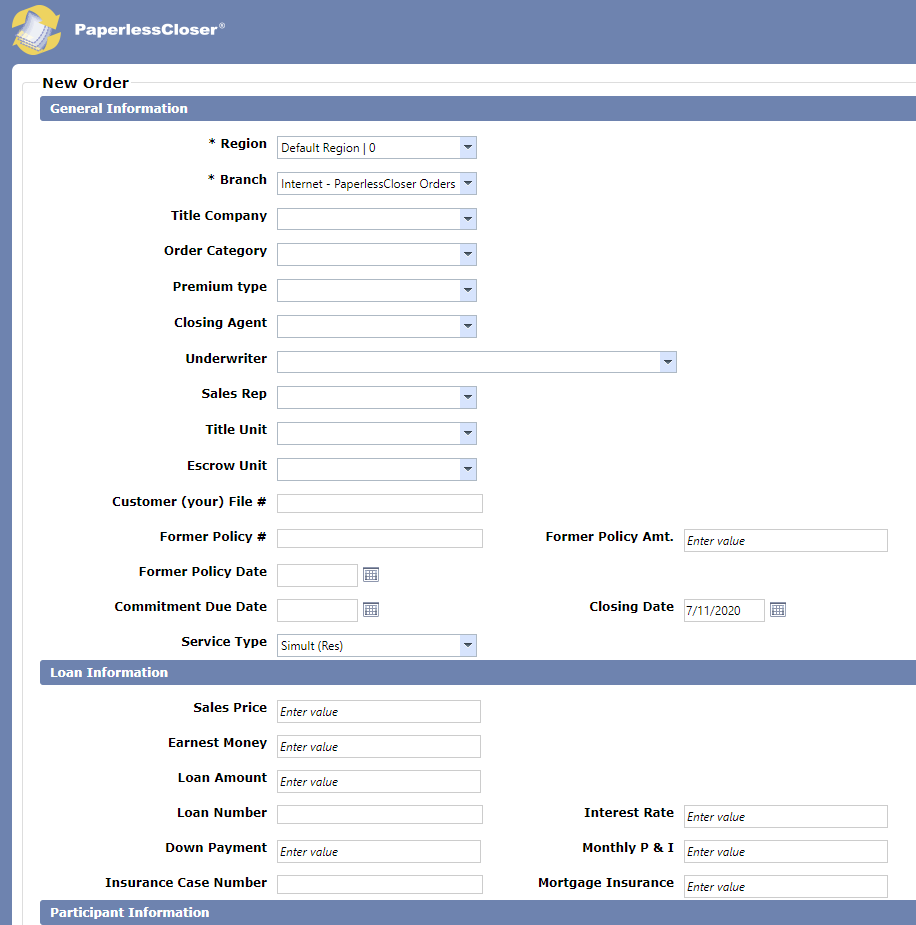

Another way to submit a new order to us is through PaperlessCloser. Access to this program can be found on the main page of our website or through the Client Login drop down. This will direct you to the log on for PaperlessCloser. Once logged in there will be a button for New Order in the bottom right corner.

Fill in the fields with your information and hit Add Order. This will send your order directly to our system so we can get it started for you.

We can get pretty much anything started with an address or current owner so don’t let the details slow you down; feel free to submit what you have, and we will help you with the rest. However, if you can provide information regarding the buyer or sellers marital status, that will help us immensely in the initial stages! For more information on placing orders or all things title insurance, feel free to give us a call or send an email! We are so happy to help.