Imagine this: you’re reviewing an informational or a commitment from the title company and you notice the legal description contains a tract in a government lot. What does this mean? Is this a concern for my transaction? This is one instance in which the word “government” is nothing to worry about! Legals with Lippman is back to discuss government lots and what they mean to you or your client.

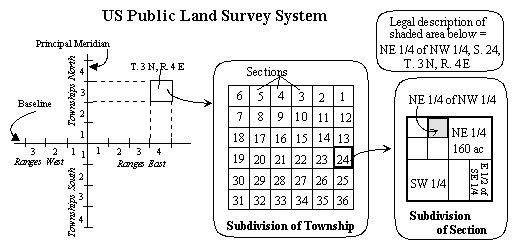

Government lot is a term used within the Public Land Survey System a.k.a PLSS. We briefly talked about PLSS in our first Legals with Lippman. PLSS dates back to 1785 in the United States and is the system that breaks real estate into Section-Township-Range (STR).

Fun fact: Not all states adopted the PLSS, most notably the Thirteen Colonies.

So, what is it?

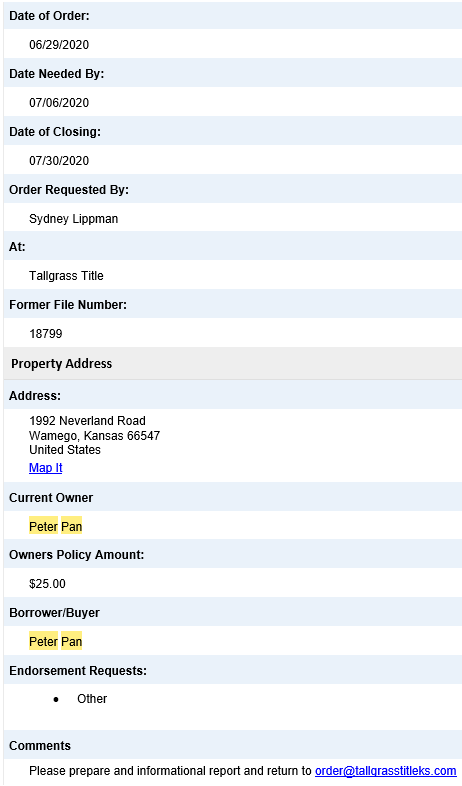

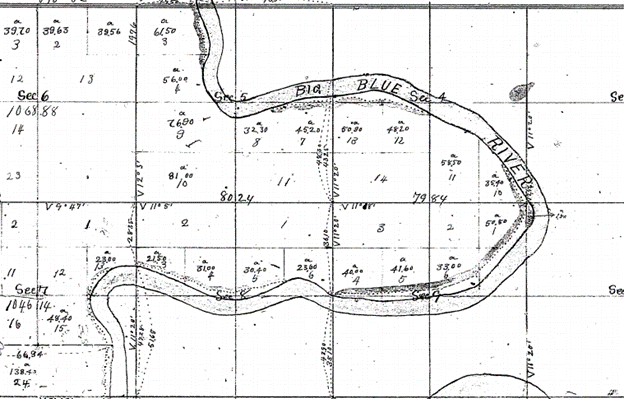

A government lot is an irregular portion of a Section as formed by a meandering body of water, impassable object, or another boundary (state, reservation, grant, etc). These “lots” are used in Sections with an irregular shape or acreage (containing less than or more than the 640 acres seen in a standard Section). While called lots, these are not the type of lot that you would see in a platted subdivision. These lots are surveyed by the government (see example from Township 10, Range 8 below) and unlike a platted lot, do not have the zoning regulations, setback lines, or restrictions that are sometimes seen on plats.

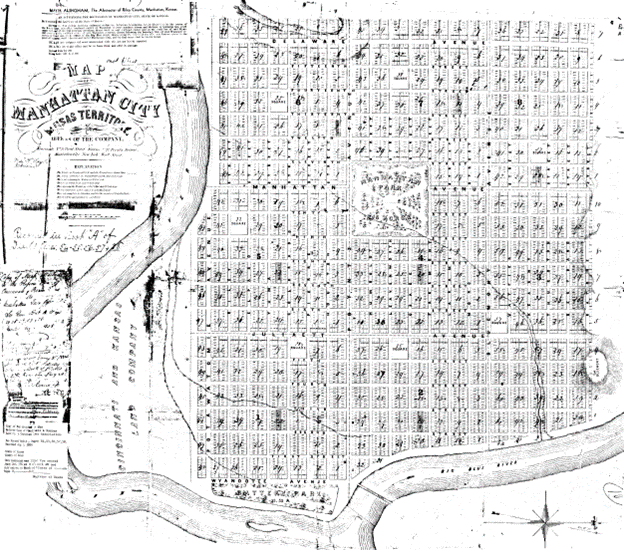

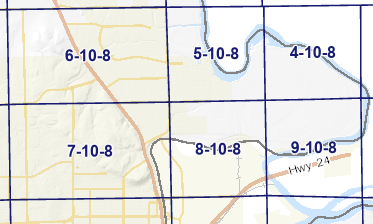

In Riley County, for example, we see government lots formed by the Big Blue River and by Fort Riley. More specifically, if we examine a survey of the government lots in Township 10, Range 8, we see how Sections 5, 4, 9, and 8 are encompassed by the Big Blue River, making them slightly irregular.

On modern versions of an STR map you can see how these Sections have some variation in size; this is another indication of the presence of government lots.

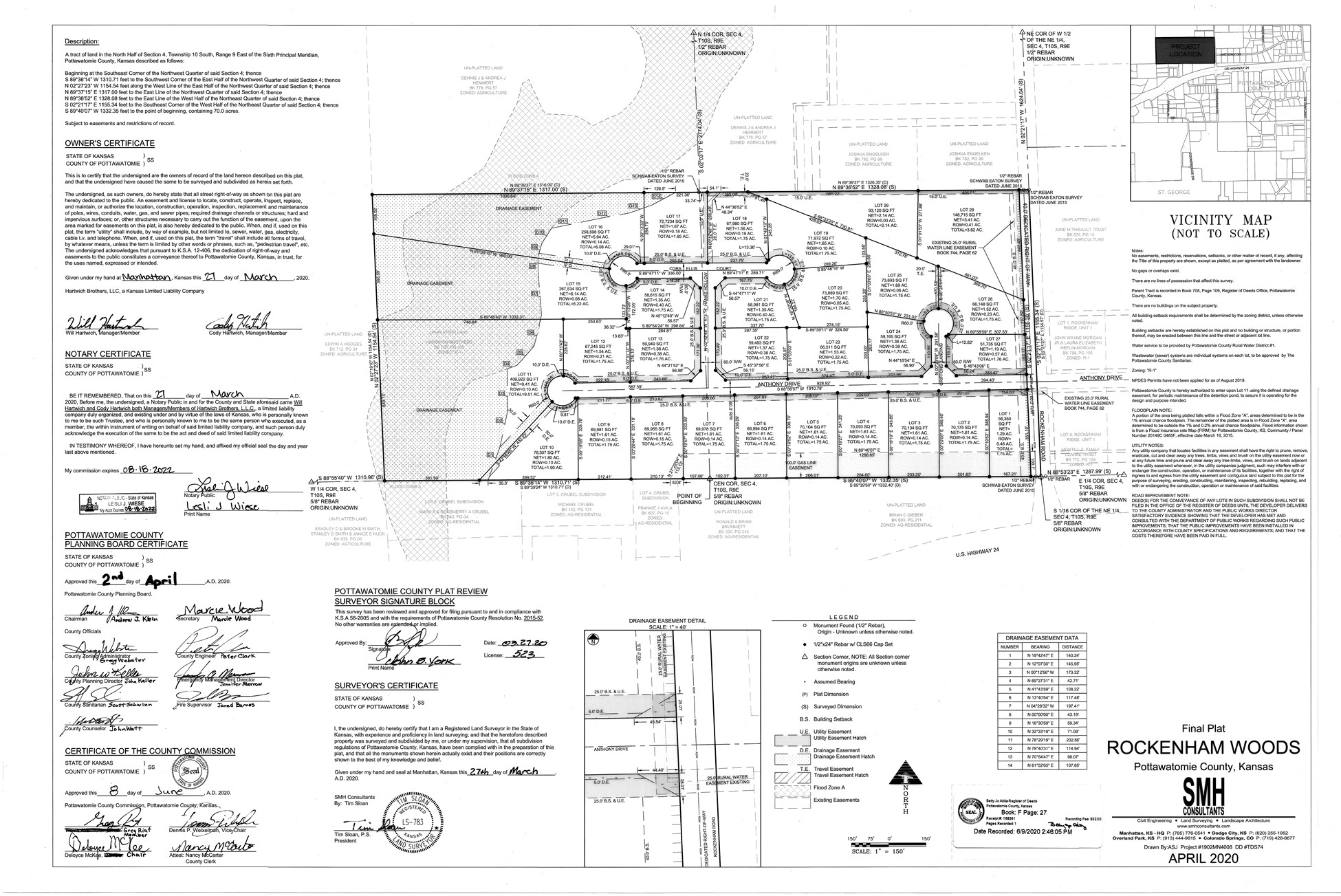

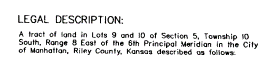

In an STR legal description you will see these irregular portions referenced as either a ‘government lot’ or a ‘lot.’ This is an example of a tract from Section 5, Township 10 South, Range 8 East, which is located near the Big Blue River. Another county might refer to these tracts as “government lots 9 and 10.”

So, what does this mean for my property? Owning part of a government lot is no different from owning land with any other STR legal description. There are no special restrictions or government regulations. A government lot is simply a way to make abnormal shapes and acreages fit into a standard section in the PLSS. If you see a government lot listed in your legal description, there is nothing to worry about!

We love helping and we love legal descriptions; if you have a question about your or your client’s legal description, give us a call!