As we prepare to close a transaction, we create settlement statements, which are documents demonstrating all debits and credits associated with the transaction. The American Land Title Association (ALTA) has provided a standard template for these forms, so they are recognizable and readable, no matter which title company you close your next transaction with. Whether the transaction is cash or financed, our office will provide ALTA Settlement Statements to both the Buyer and Seller. The Buyer and Seller statements are unique to their respective side of the closing and can only be shared with the other party if we have express permission in writing.

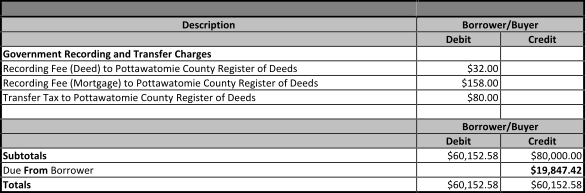

Sellers

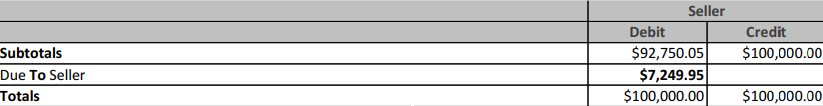

When reviewing the Seller Settlement Statement you will find the sales price, any applicable credits the Seller gave to the Buyer in the contract, a tax proration (either a credit or debit depending on the time of year and if Seller paid them prior to closing or not), title expenses that consist of closing fees and title insurance premiums owed to the title company, any commissions due to realtors, payoffs of current liens, and any invoices or repairs that the Seller has agreed to pay for.

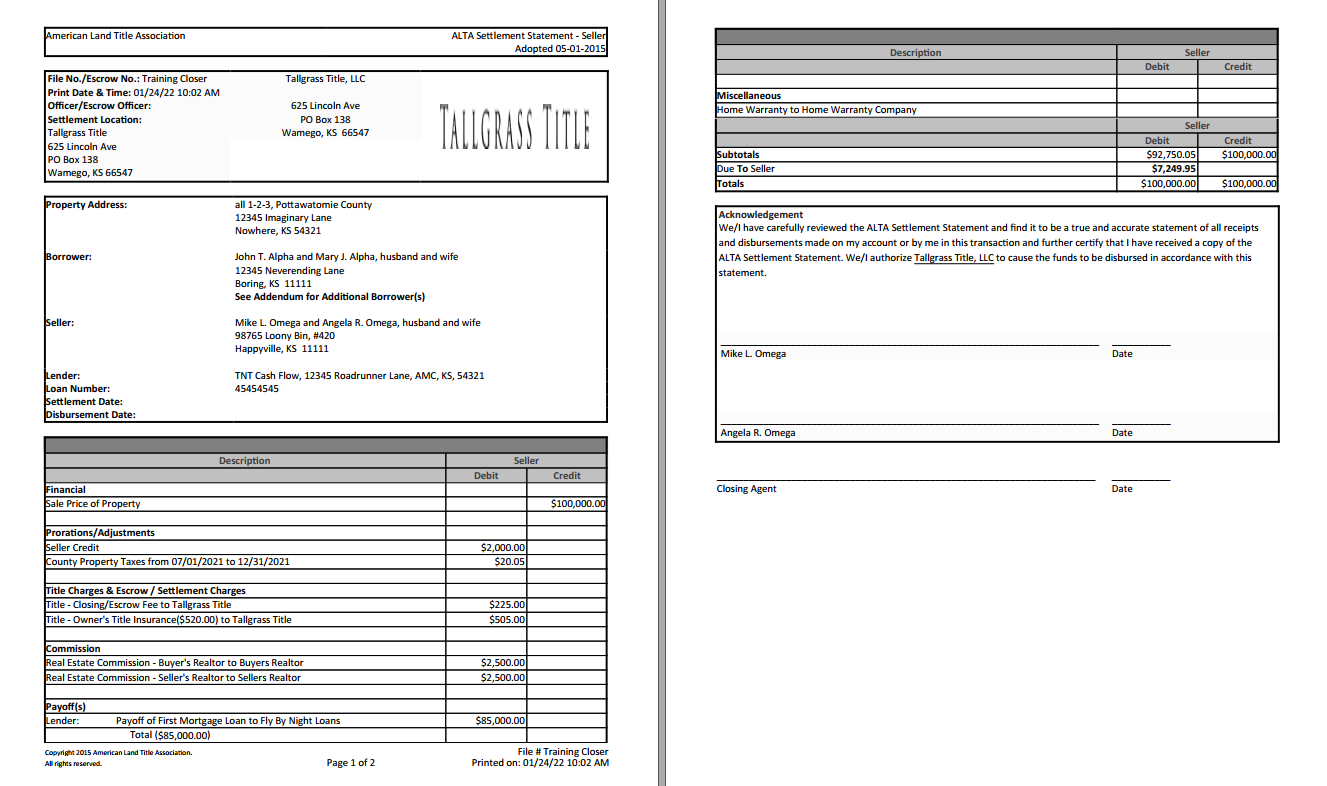

Buyers

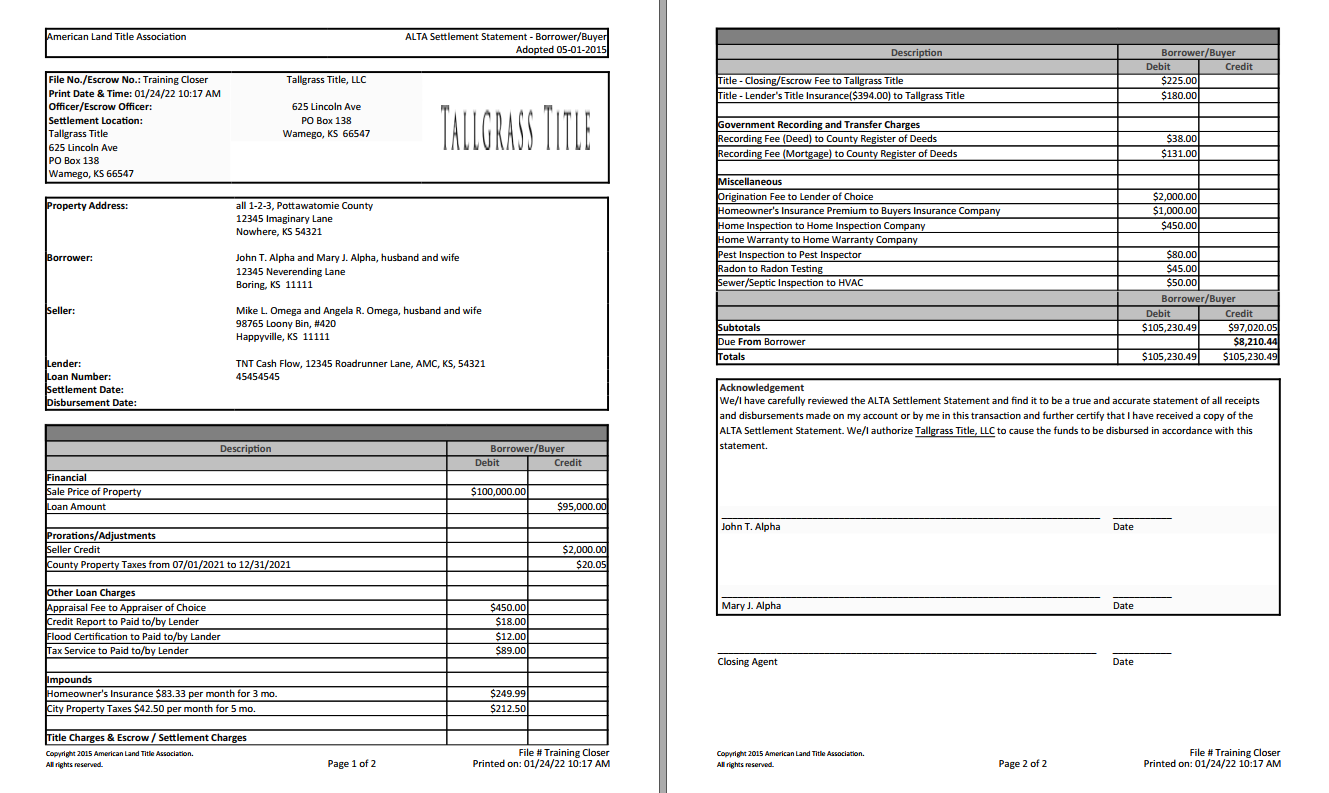

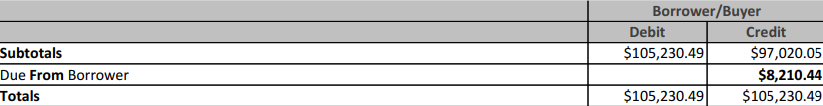

When reviewing the Buyer Settlement Statement you will find the sales price, any applicable loan amounts, any applicable Seller credits the Seller agreed to within the contract, a tax proration (either a credit or debit depending on the time of year and if Seller paid them prior to closing or not), loan closing charges determined by the lender, impounds for the Buyers new escrow account collected at closing by the lender, title expenses that consist of closing fees and title insurance premiums owed to the title company, recording fees to file the deed and mortgage of public record with the county register of deeds office, and fees for any inspections or additional work the Buyer has requested prior to closing.

Buyer Settlement Statements may also be referred to as Buyer Settlement Statements.

Bottom Line

Both the Buyer and Sellers statements will include an amount that is either due from or due to that party. If an amount is due from, this represents the amount due to the title company to close the transaction. If an amount is due to, then you should expect a proceeds check following closing!

Signing

As part of “closing” Buyers and Sellers need to review and sign their respective ALTA settlement statements in order to acknowledge their acceptance of the breakdown of debits, credits, and bottom line.

Sellers are more than welcome to sign in our office, with their realtor, on their own or electronically.

Buyers of cash purchases can do the same as above but in the case of a loan will need to sign with the title company, lender or mobile notary.

Questions?

If you have questions about you or your client’s ALTA Settlement Statement, give us a call! We are here to help make this a positive experience.