A few days before your closing, you can expect to receive a document or two called a Settlement Statement and maybe even something called a Closing Disclosure. These documents can look a little intimidating, but we can give you some pointers to help you understand what is going on.

For cash transactions or transactions with in-house financing, you can expect to receive a simplified Buyer’s or Seller’s Statement. This simple statement is set up to be pretty easy to read. Here at Tallgrass Title, we give a separate sheet to the Buyer and a separate one to the Seller to protect your privacy. The fees are set out in a list as shown in the sample Seller’s Statement below:

As you can see, there are two columns showing the debits and credits with the subtotals at the bottom. The last line item is the actual proceeds amount that will be given to the Seller.

If you are purchasing a home and obtaining financing, you may get a loan that will be sold on the secondary market. If you are getting this type of financing, your Lender will give you a document called a Loan Estimate soon after you apply for the loan. Then, during the week before closing, you will receive two final settlement documents. One is called the Closing Disclosure and the other is called the ALTA Settlement Statement. The good news is that these documents will have very similar numbers; the bad news is there are a few more sheets to read through.

The Buyer’s Closing Disclosure is 5+ pages long. Here is a brief overview of what is on each page: 1. Basic details about the type of loan. 2. List of fees associated with the transaction. 3. Credits, subtotals and the grand total of funds you will need to bring to closing. 4 & 5. Further details about your loan and contact information for your Lender, Realtors, and your Title Company. The Seller’s Closing Disclosure is usually 2-3 pages long. Page 1 shows details of the transaction, subtotals and totals. Page 2 lists the fees the Seller has agreed to pay.

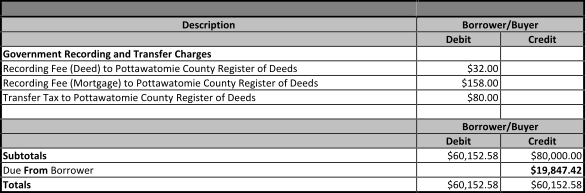

We prepare the ALTA Settlement Statements to go along with the Closing Disclosures. These documents are formatted differently from the simple Statements, but they still show a line-by-line breakdown of the closing fees. Here is a sample of what part of one looks like:

As on the simple version, there is a separate line showing the amount “Due From Borrower”. This is the amount the Buyer will need to bring to closing.

The thing to remember is that you will want to review the documents as soon as possible after receiving them. Don’t wait until the closing to ask your Lender or us any questions that you may have. If you wait until closing to ask your questions it could possibly delay the closing. Please remember that we at Tallgrass Title are always happy to take the time to answer questions and explain information.