A commitment for title insurance is a report your title company prepares containing information about your current or prospective real estate. If the requirements of the commitment are met, we are bound by law to issue you a “title insurance policy.” The policy is ultimately what insures your ownership in the real estate. However, the commitment is the document you will receive prior to closing. After entering into a contract, you will receive a commitment from your title company. This is your opportunity to understand whether there are any defects in the title or whether there are certain liens or easements that will prevent you from purchasing the real estate.

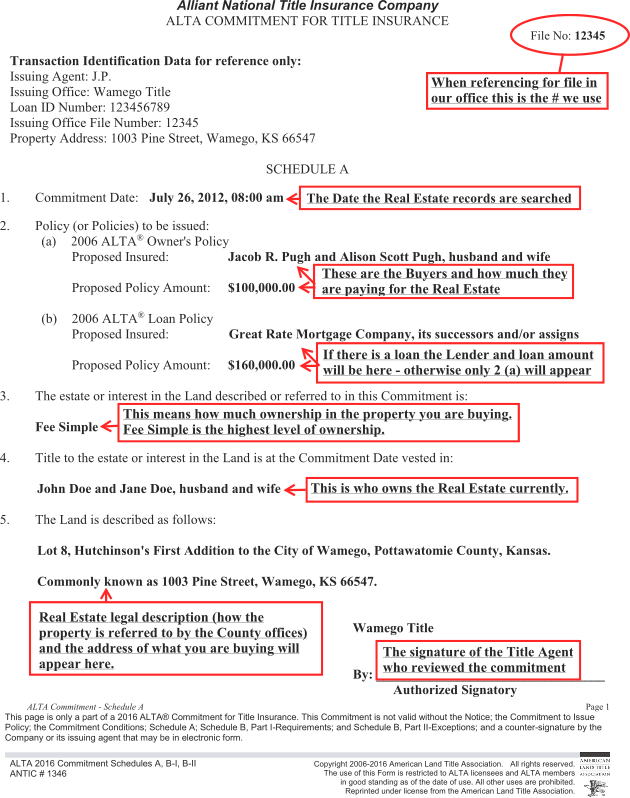

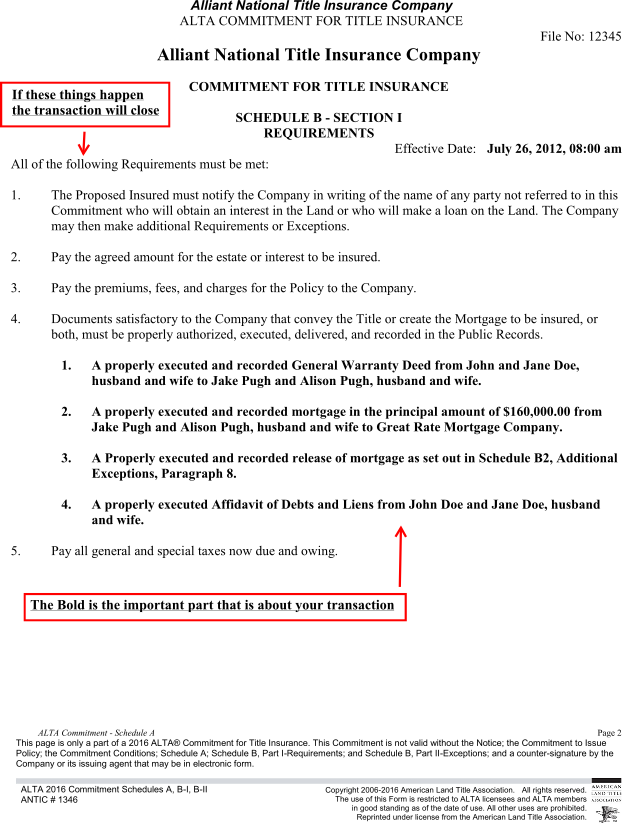

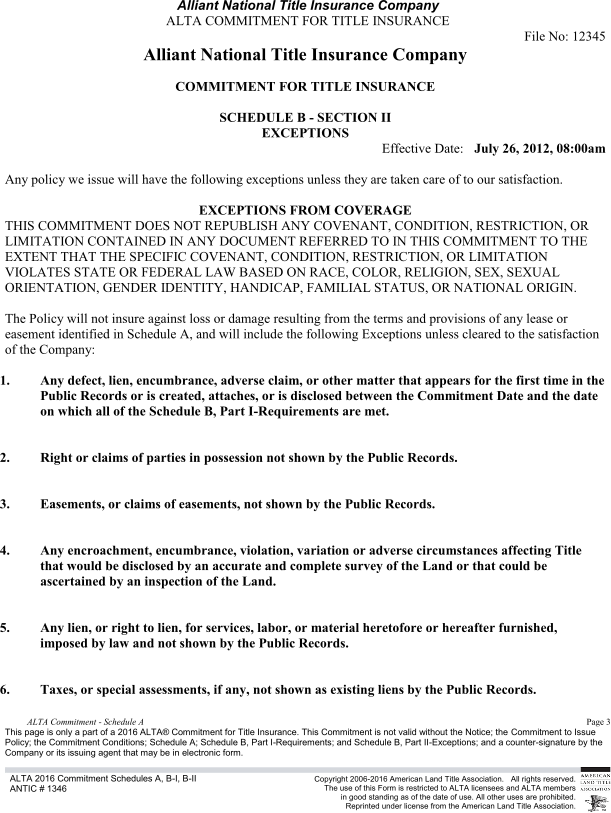

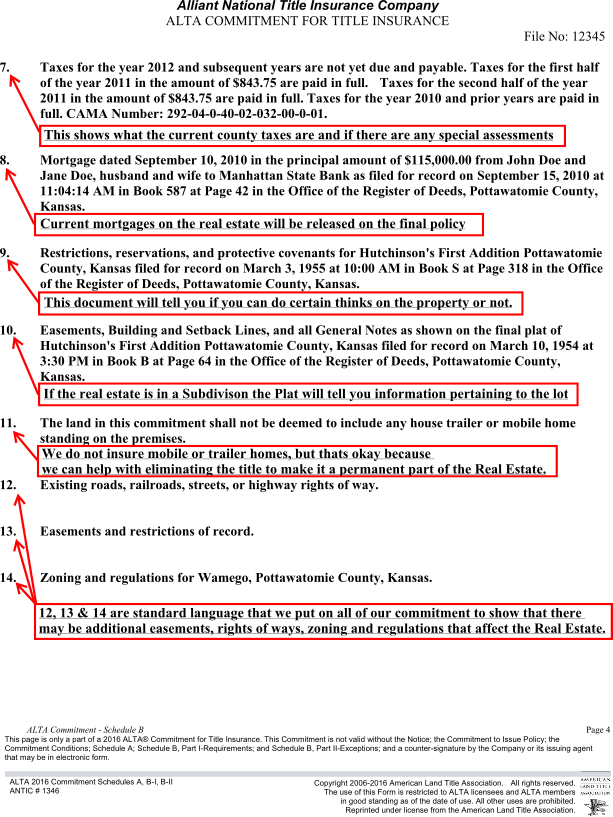

The first few pages of your title commitment will include a commitment jacket full of standard information and a privacy policy that is not transaction specific. I have omitted these pages from this post to focus our attention on the information about your real estate. The below diagram points out the highlights of your commitment.

Even with this diagram, understanding a title commitment can be confusing. If at any time you have questions regarding your title commitment or any phase of the transaction, please feel free to contact our office. We are here to help and answer any questions you have. That’s our job!