A common cause for the sale of real estate is when an individual passes away. As a listing agent preparing to list and market the real estate, it is important to answer a few questions regarding the status of the real estate. You do not want to sign a contract with a buyer, only to find out that the seller does not have the ability to sell the real estate. Similarly, when representing buyers, it is important to determine whether the seller has the ability to sell the real estate or if there will be a delay in transferring title. The purpose of this post is in no way meant to be a guide for decedent’s estates. Instead, the purpose is to identify a few of the common pitfalls and items that routinely delay closings.

When a person passes away owning real estate in Kansas, that real estate will pass to the people identified by the decedent (a person that has died) in some written document. If no such document exists, the real estate will pass to the “heirs” of the decedent as directed by Kansas law. The three methods of passing real estate by written document are:

- Transfer on Death Deed or Joint Tenancy Deed

- Trust

- Will

A Transfer on death deed or joint tenancy deed will automatically transfer the ownership of real estate to the person or persons identified in the deed. The filing of a death certificate at the register of deeds is all that is required to finalize the transfer. As a real estate agent, take a look at the deed or ask your title company to take a look to verify that the seller has the authority to transfer title.

The second method is through a trust. Typically, but not always, the trustee of the trust will have the authority to sell and transfer real estate. However, there are innumerable varieties of trusts with varying powers being granted the trustee. Therefore, it is wise to verify that the trust document grants authority to sell real estate to the trustee. Additionally, it is important to make sure that there are not special requirements in the trust document that must take place before a sale is allowed. For example “I grant the trustee the right to sell real estate….so long as my son does not want to purchase the real estate at the appraised value.” This example illustrates a potential issue that could delay a sale.

Lastly, if the decedent had a will or passed away without a will, a probate proceeding will be needed prior to a sale. Simply put, probate is the court process of transferring assets of a decedent to those entitled to the assets. The most important thing to remember with a probate proceeding is that it is not a quick process. It usually takes at least sixty days from the first court document filed until authority is granted by a judge for the sale of real estate. Based upon the buyer, this may be an unacceptable amount of time to wait. If you are unsure of where the probate process is, simply contact the attorney representing the estate and ask.

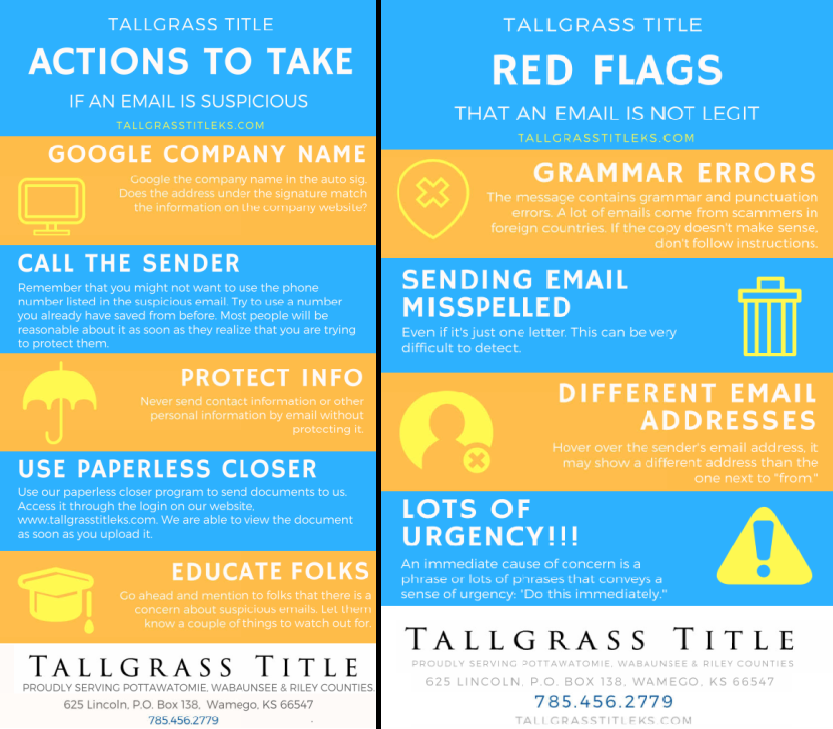

Decedents estates can be overwhelming and often times complicated. At Tallgrass Title, our attorneys have years of experience transferring real estate following death. We are happy to answer questions pertaining to your transaction. It’s our job!