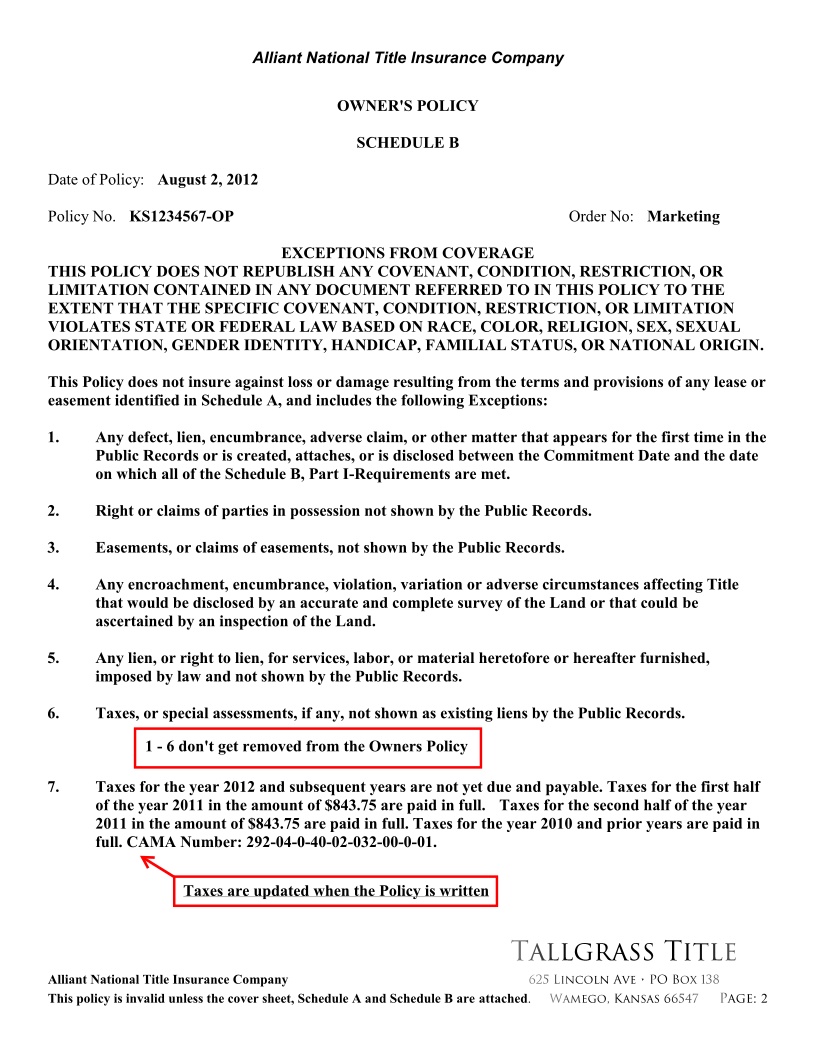

Towards the end of the Title Insurance Commitment, you will find a list of “Exceptions from Coverage”. This list appears in Schedule B – Section II. The Standard Exceptions are general and appear on every commitment. However, many of the Additional Exceptions are specific to your tract of real estate. Here are some common types of documents that show as Additional Exceptions:

-

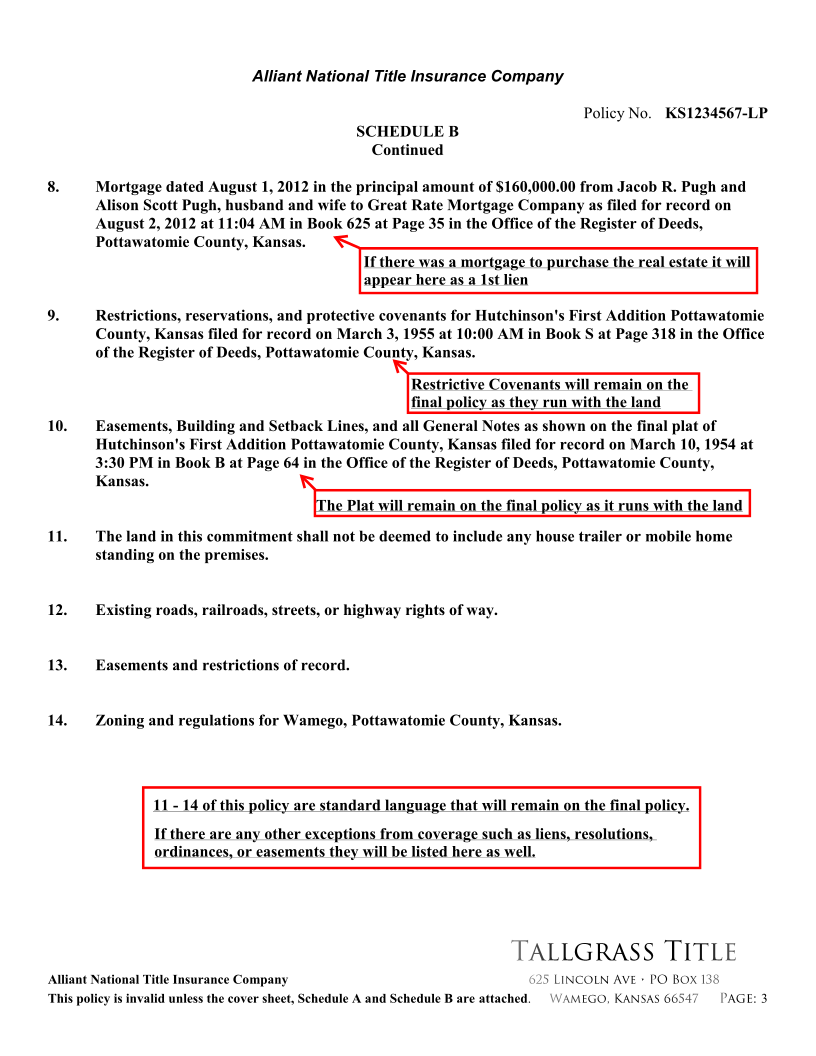

Plat

A plat is a picture of a subdivision. It is basically a drawing that shows the shape of the lots, and where the roads are. Many also show utility lines and easements originally planned by the developers.

-

Restrictive Covenants

Restrictive Covenants list any restrictions on lots located in a subdivision. The purpose of these is to ensure that the owner of each lot can enjoy his real estate without causing annoyance to his neighbors. Many of these documents also contain rules concerning the upkeep and appearance of the subdivision. For example, these may include specific guidelines on what materials or color(s) are used for your house. They may also contain rules about fences, additional structures, or vehicle parking. These documents may include information about setting up a Homeowner’s Association (or HOA).

-

Oil & Gas Leases

In certain parts of Kansas there is active exploration and production of oil, natural gas, and other natural resources. In the past, there were many oil and gas leases given, but a good number of them did not result in any actual activity. Additionally, many of them were for a certain number of years and the terms have already expired. Most of the leases we see on property searches today can be dropped off from the policy by a simple affidavit signed during closing. For more information on oil and gas leases, click here to view a blog we posted earlier this year.

-

Ordinances

An ordinance is a public declaration made by the city. These may have some effect on your real estate, depending on what type of ordinance it is. For example, the document may provide for the installation of water lines or sidewalks.

-

Easements

Easements give other persons the right to use your real estate for a specific purpose. A very common easement is an “ingress/egress easement”. This allows someone to travel across your real estate usually to access real estate they own adjacent to yours. Another very common easement is a utility easement. These agreements allow electric, natural gas, or other specified companies to construct or maintain utility lines. Most easements contain language saying that the easement will “run with the land”. This means that when you sell your property, the new owners will have to honor the easement. As mentioned above, an easement is for a particular purpose. As the owner of the real estate, you do have the right to make sure that the person using the easement isn’t trespassing on or causing damage to another part of your real estate.

As you review your title insurance commitment, please remember that you can ask for copies of the documents that are listed. At Tallgrass Title we are happy to answer any questions to help make your transaction as smooth as possible.